utah state solar tax credit

State solar tax credit in Utah. The Utah tax credit for solar panels is 20 of the initial purchase price.

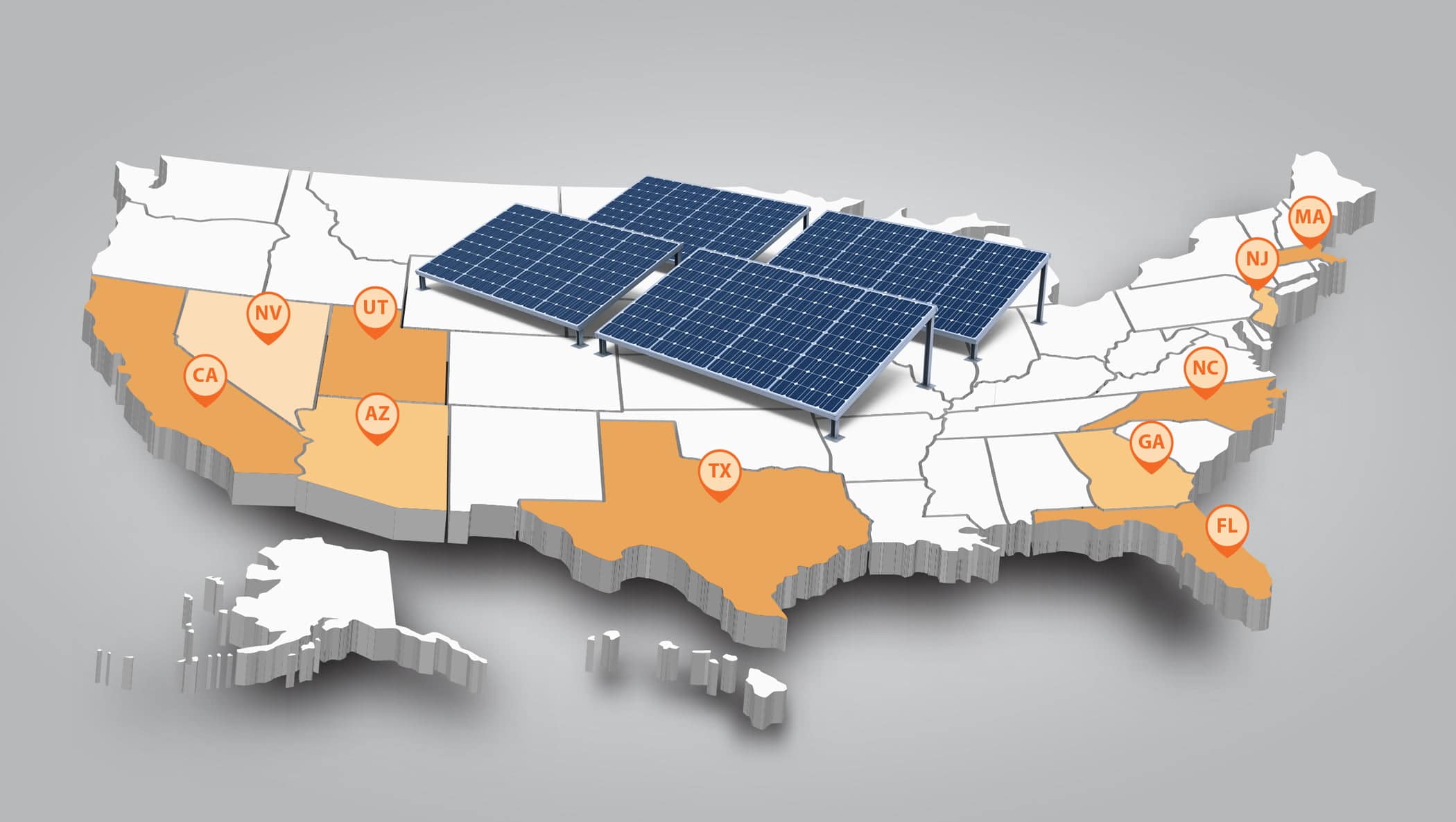

Solar Panel Installation Us La Solar Group

Gary Herbert and the Utah State Legislature for two new laws the industry advocated for that will help future solar homeowners through cost savings and increased consumer protection.

. Utah State Solar Tax Credit. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable income. Utahs solar tax credit currently is frozen at 1600 but it wont be for long.

Calculate Your Cost To Go Solar. You can receive a maximum of 1000 credit for your purchase. Whether you are just starting to look.

The actual amount and duration of an incentive is determined by the Office. The Alternative Energy Development Incentive AEDI is a post-performance non-refundable tax credit for 75 of new state tax revenues including state corporate sales and withholding taxes over the life of the project or 20 years whichever is less. 25 Combat Related Death Credit.

21 Renewable Residential Energy Systems Credit. 17 Credit for Income Tax Paid to Another State. State Of Utah Solar Tax Credit.

Utah homeowners have access to the Utah Renewable Energy Systems Tax Credit which is the state solar tax credit. Ad Utah state solar tax credit. There is no tax credit on solar panels that you purchase and then sell to someone else.

Roofs that qualify can enjoy monthly savings on electricity claim thousands in tax credits and even qualify for 0 down approval with partnered installers within our network. SunPowers production branch led to the development of Maxeon Solar its own existing solution assortment of solar powers. Utah offers state solar tax credits -- 25 of the purchase and installation costs of a solar system -- up to a maximum of 2000.

A Comparison List Of Top Solar Energy Companies Side By Side. 12 Credit for Increasing Research Activities in Utah. Utahs solar tax credit makes going solar easy.

For Utah solar shoppers state and local tax credits mean theres never been a better time to start exploring solar offerings. With most Utah homeowners paying 21440 for their solar systems the majority of residents will be eligible for the entire 800. 27 Veteran.

13 Carryforward of Credit for Machinery and Equipment Used to Conduct Research. 4 4 solar panels created from. Get Pricing Calculate Savings.

Utah State Energy Tax Credits. 1600 is the maximum amount of credit you can get for solar in the state of Utah and all our systems qualify for the maximum credit. Utah State Tax Credit Solar.

Utah State Tax Credit Solar. Four 4 photovoltaic panels designed coming. File with your state taxes.

This law extended the state solar tax credit by two years. Maxeon 3 sunlight points are developed along with IBC cell technology a Gen 3 development along with several excellent attributes. The tissue technology adopts a 104-cell design template designed to increase output and also surpass series of previous regular models.

If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income. So while there is a state solar tax credit in Utah there are no solar energy rebates or solar sales tax exemptions here. Ad Step 1 - Enter ZipCode for the Best Utah Solar Pricing Now.

Ad Find The Best Solar Energy Quotes In Your Area. Fill out the rest of the form as you normally would when filing your state taxes. Find The Best Option.

Under the Amount column write in 1600. The credit is being phased out however with a cap of 800 until December 31 2022 then 400 until the credit expires at the start of 2024. Our network of energy specialists and solar installers make it simple for homeowners to know how much they are eligible to save.

19 Live Organ Donation Expenses Credit. Because this tax credit was going to skew data hardworking solar advocates worked to prolong the Utah solar tax credit and Gov. Low Cost Utah Solar Options for Less - Hire the Right Pro Today and Save.

The SunPower brand possesses powerful origins in production and technology with numerous of its components pre-dating its huge market excellence. Herbert signed Senate Bill 141 into law in March of 2018. Fill in line 16 only if you do not have the tax.

And SALT LAKE CITY UT - The Solar Energy Industries Association SEIA and the Utah Solar Energy Association USEA jointly thanked Utah Gov. Check Out the Latest Info. Everyone in Utah is eligible to take a personal tax credit when installing solar panels.

Renewable energy systems tax credit. Check Rebates Incentives. The Utah tax credit for solar panels must be used within 3 years of the purchase date of the solar panels.

The credit is for 25 of your total system cost up to a maximum of 800 for systems installed in 2022. Browse Our Collection and Pick the Best Offers. Read Our Trusted Reviews Now.

Ad Find Top Rated Solar Companies in Your Area. And dont forget the Federal rebate for installed solar systems is 30. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum of 1600.

The SunPower label has tough roots in manufacturing and also technician along with numerous of its own modules pre-dating its astronomical market excellence. SunPowers production arm caused the development of Maxeon Solar its present service assortment of photovoltaic panels. The Utah solar tax credit the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects.

Utah Solar Incentives Creative Energies Solar

What Is The Federal Solar Tax Credit Sunpower

Solar Investment Tax Credit Itc At 26 Extended For Two Years Creative Energies Solar Solar Design Residential Solar Solar

Crowdfunded Solar Puts Red Lake Nation On A Path To Energy Sovereignty The Red Lake Band Of Chippewa Indians In Minnesota Are Inv Red Lake Solar Solar Projects

Solar Panels Utah Incentives Tax Credits Rebates Cost

Free Solar Energy Estimate In Arkansas Atlantic Key Energy

Advocating For A More Inclusive Federal Itc Tax Credit For Rooftop Solar Savings Vote Solar

How Solar Panels Are Made Blue Raven Solar

Solar Panel Recycling A Circular Economy For Renewable Energy Frontier Group

Solar Tax Exemptions Sales Tax And Property Tax 2022

Going Solar New Program Offers Discounts To Slc Homeowners Ready To Make The Switch Ksl Com

Preventive Solar Denver Address 7315 S Revere Pkwy 604 Suite C Centennial Co 80112 Http Www Preventivesolardenver Com Utah Solar Generation

Solar Resource Data Tools And Maps Solar Map Analysis

Solar Energy Bureau Of Land Management

It Could Be The Beginning Of A Solar Boom In Utah Solar Solar Power Utah

Solar Tax Credit Vs Trec Which Incentive Is Best In New Jersey Green Power Energy

Residential Energy Credit How It Works And How To Apply Marca

Leasing Vs Buying Solar Panels Which Is Best For You Forbes Advisor